Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Miner Anglo American has rebuffed a takeover proposal from its larger rival BHP Group, declaring that the £31.1bn offer is “opportunistic” and “significantly” too low.

A day after the mining sector was shaken up by BHP’s approach, Anglo’s board has unanimously rejected the proposal.

The company says:

The Board has considered the Proposal with its advisers and concluded that the Proposal significantly undervalues Anglo American and its future prospects.

It gives several reasons: not only is the offer too low, but Anglo isn’t impressed by the structure of BHP’s all-share proposal, citing uncertainty and complexity, and “significant execution risks”.

Under BHP’s plan, Anglo would demerge its entire shareholdings in Anglo American Platinum Limited and Kumba Iron Ore Limited to its shareholders first, before being acquired, as BHP is mainly interested in its copper mines.

Announcing the rejection of BHP’s approach, Stuart Chambers, chairman of Anglo American, tells the City:

“Anglo American is well positioned to create significant value from its portfolio of high quality assets that are well aligned with the energy transition and other major demand trends.

With copper representing 30% of Anglo American’s total production, and with the benefit of well-sequenced and value-accretive growth options in copper and other structurally attractive products, the Board believes that Anglo American’s shareholders stand to benefit from what we expect to be significant value appreciation as the full impact of those trends materialises.

Chambers adds that Anglo American is “entirely focused” on delivering its strategic priorities.

The company owns mines in countries including Chile, South Africa, Brazil and Australia, but a series of missteps – including disappointing production rates last year – have left it vulnerable to a takeover approach.

But some analysts have already suggested that BHP might have to improve its offer, or that other bidders could also enter the fray with their own proposals….

Yesterday, Anglo’s shares surged 16% and closed slightly higher than BHP’s offer (which is worth £25.08 per share). That implies the City expected the initial proposal to be rebuffed.

Jamie Maddock, energy analyst at Quilter Cheviot, said:

The fact that the shares are trading just above what BHP is offering suggests one of two things – either BHP is going to up its offer or sweeten the deal in some way, or a second offer comes forward from another diversified miner like Glencore.

The deal premium feels relatively low, particularly in the context of recent M&A offers and the heightened complexity hence something above £30 per share could be likely to get it done.

The agenda

7.45am BST: French consumer confidence report for April

9.30am BST: UK insolvency statistics for March

11.30am BST: Bank of Russia interest rate decision

1.30pm BST: PCE measure of US inflation index for March

3pm BST: University of Michigan indx of US consumer confidence

Filters BETA

NatWest has announced that the government’s stake in the bank has dipped below 28%.

The Treasury’s holding in NatWest has fallen to 27.93%, down from 28.90%, as part of the ongoing trading plan which began in August 2021.

At its peak, the UK owned of around 84% of the bank, when it was known as Royal Bank of Scotland and was rescued in the 2008 banking crisis.

The government is planning to offer its shares in NatWest to the general public this summer.

NatWest Group, CEO Paul Thwaite told reporters this morning:

“Returning NatWest Group to private ownership is a shared ambition and one that we believe is in the best interests of the bank and all our shareholders.”

Regular polling by the Office for National Statistics, tracking public attitudes to the big issues of the day, has been released today.

For some time the cost of living crisis has topped the poll, and the latest figures for the period 10 April to 21 April show no change there.

When asked about the important issues facing the UK today, the most commonly reported concern was surprisingly still the cost of living (87%), followed by the NHS (86%) and the economy (70%).

It’s a blow for the government that steeply falling inflation has had little effect on public attitudes.

Average pay has risen more quickly than prices over recent months, but it would seem that the dramatic price increases of the last three years continue to leave people feeling worse off.

A fall in inflation only limits and does not reverse prices growth.

The ONS said other commonly reported issues were climate change and the environment (61%), housing (55%), crime (55%), immigration (51%) and international conflict (50%).

Some happy news: insolvencies among both individuals and companies fell last month.

The number of registered company insolvencies in England and Wales dropped to 1,815 in March, which is 17% lower than in February and than in March 2023.

The Insolvency Service reports that insolvencies fell across the board last month, with 261 compulsory liquidations, 1,437 creditors’ voluntary liquidations (CVLs), 108 administrations and 9 company voluntary arrangements (CVAs) in March.

The fall in insolvencies is surprising, given the pressures that businesses face from high interest rates, weak economic growth and squeezed consumers.

Trevor Wood, partner and insolvency specialist at international law firm Vedder Price, fears it may be a blip, though. He explains:

Today’s figures are extraordinary. I don’t think anyone will have been expecting a fall in insolvencies. All the signs on the ground were that insolvencies would rise as businesses continue to struggle to adjust to the high interest rate environment, which has ratcheted up operating costs and caused real funding issues for struggling companies.

The reality seems to be that businesses and investors have managed to adjust, cutting their cloth successfully to match the economic climate. This is a real bolt from the blue – but a welcome one.

David Hudson, restructuring advisory partner at FRP, says:

“High levels of insolvency were already baked into expectations for this year so any sign of a slowdown in volume is welcome.

That said, with economic growth remaining weak and many pausing investment in anticipation of a General Election, it’s highly likely that more businesses – many still saddled with post-Covid debts – will falter under the weight of elevated input and borrowing costs.

The Insolvency Services has also reported that 8,708 individuals entered insolvency in England & Wales in March 2024, 19% lower than in February 2024 and 9% lower than in March 2023.

Darktrace’s takeover is “the same story” of an undervalued UK asset being taken out, says Neil Wilson of Markets.com:

Something has come loose in the UK market, like a hose pipe that was blocked up suddenly gushing forth.

Another deal announced today for Darktrace and another record high for the FTSE 100. Nick Train suggested a transformative deal could unleash pent-up demand for UK stocks and close the valuation gap – maybe BHP’s move on Anglo American is just such a deal.

The FTSE 100 rose to a new intraday high of 8,139.92 this morning as European indices were broadly higher on some better news from US tech giants Microsoft and Alphabet.

Train, who is one of the City’s best-known stock-pickers, told Financial News this week that investor sentiment about unloved domestic shares could improve if there was a takeover bid for a “substantive UK company”…..

Darktrace’s decision to accept the terms of Thoma Bravo’s takeover offer will add yet more fuel to the argument that the London Stock Exchange is in some trouble.

Indeed, Darktrace takes a swing at the London market today, saying it hasn’t been properly valued since floating three years ago.

Darktrace says:

Whilst the Darktrace Board remain confident that Darktrace’s strategy can continue to deliver attractive returns for shareholders and that Darktrace has a strong future as a public company, the Darktrace Board believes that Darktrace’s operating and financial achievements have not been reflected commensurately in its valuation with shares trading at a significant discount to its global peer group.

Darktrace floated at 250p per share in April 2021, and swiftly soared to £10 by September 2021 amid excitement about the prospects of its technology, which uses artificial intelligence to create digital security products.

But its shares then fell back, after stockbroker Peel Hunt questioned its high valuation and said Darktrace customers had described its technology as “snake oil”.

Darktrace then came under attack from short sellers, betting against its share price.

Shares in Darktrace have jumped to 620p – matching Thoma Bravo’s takeover offer – which is their highest since November 2021.

The FTSE 100 reached yet another record high this morning as investors remain in a positive mood, reports Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown:

There has been a flurry of strong results from big hitters like Barclays and AstraZeneca on Thursday, which has helped carry the FTSE to these new highs.

The market’s also reacting to the news that consumer confidence has improved slightly, according to data from GfK. Anglo American has also rejected BHP’s surprise takeover bid, deeming the multi-billion pound offer as unattractive.

The proposed deal would hugely reshape the business, and the Anglo board has suggested the current bid isn’t reflective of the opportunity. There’s every chance BHP will come back to the table, and these conversations will remain the core cause of market reactions for both groups.

Newsflash: Another UK company has fallen to a takeover approach.

Darktrace, the British artificial intelligence and cybersecurity company, has agreed to be taken over by US private equity firm Thoma Bravo.

The recommended all cash acquisition values Darktrace at £4.25bn.

Thoma Bravo are paying $7.75 in cash, or 620p, for Darktrace, a 20% premium on last night’s closing share price of 517p.

Shares in Darktrace have jumped by 16% to 602p, the top rise on the FTSE 250 index of medium-sized firms.

Thoma Bravo says the acquisition of Darktrace is “an attractive opportunity to increase its exposure to the large and growing cybersecurity market”, and to invest to accelerate Darktrace’s development.

Thoma Bravo had walked away from takeover talks with Darktrace in September 2022

Today, Darktrace says that its board believes its shareholders should be provided with the opportunity to consider Thoma Bravo’s offer.

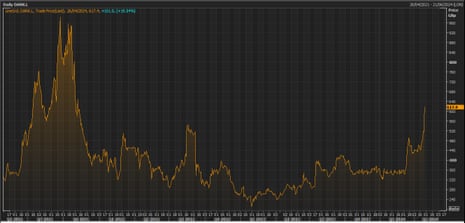

Britain’s blue-chip FTSE 100 share index has hit a new intraday high, for the fourth day running.

The Footsie has climbed as high as 8,136 points this morning, up around 0.7%.

Yesterday it was pushed by by the surge in Anglo American’s share price, and by Barclays and AstraZeneca after their latest financial results.

This morning, NatWest are the top riser, up 4%, after reporting a smaller-than-expected 27% drop in profits in the last quarter.

investors are also in a cheery mood, after strong results from Google’s parent company Alphabet, and Microsoft, last night.

Shares in Anglo American are basically flat at the start of trading in London.

They’re trading at £25.57, (having closed at £25.60 last night), still above BHP’s now-rejected offer of £25.08 each.

That suggests that City traders believe this morning’s rebuffing may not be the end of the matter….

Shares in BHP Group fell by 4.6% on the Australian stock market overnight, as investors there digested its approach for Anglo.

As well as lowering the value of its all-share offer, this suggests some concerns over the merits of the deal – and expectations that BHP might improve its bid.

As Brenton Saunders of investment manager Pendal put it to Reuters.

“I am a bit surprised that the deal is not an agreed deal. It likely means BHP will need to offer more to win over shareholders and management and risks creating unhelpful animosity.

“The deal is complicated in that Anglo has a complicated structure with a number of moving parts like AngloPlats, Kumba and De Beers. It’s not clear how BHP adds value to the deal if it is required to offer considerably more.”

My colleague Nils Pratley explained yesterday why BHP’s offer, although clever, was simply not high enough to succeed….

Anglo would have to demerge its two big South African units that already have separate listings in Johannesburg, Anglo American Platinum and the local iron ore producer Kumba, by distributing the shares to its own shareholders. Then BHP would buy the rest of Anglo via an all-share offer. Add it all up and BHP presented its £31bn proposal as being pitched at a 31% premium for the Anglo assets that don’t have their own listings.

In reality, few will look at the numbers that way. BHP’s own description of the “total value” of its proposal as being £25.08 a share (with the listed parts included at £8.26) implied only a 13% premium to Anglo’s closing share price on Wednesday of £22-ish. Indeed, the offer was a bit less than £25 because BHP’s own shares fell slightly.

Thus the many Anglo shareholders, including Legal & General Investment Management (LGIM) and Abrdn, who called BHP’s offer “opportunistic” are correct. A £25 offer is clearly too mean. For all its calamitous recent history, Anglo should be able to get back £30 under its own steam via self-improvement. Its shares stood at £36 as recently as January last year. Note, too, that BHP has made its move when the price of diamonds (Anglo owns 85% of De Beers) and platinum are at cyclical lows.

One must assume BHP expected such a reaction from the ranks of Anglo shareholders, so its first shot was probably a sighter. It will need to go higher if it wants to continue the pursuit. But, if the target is up for grabs, all sorts of possibilities come into play. There’s nothing to stop Anglo breaking itself up, for example. And, if it were prepared to let go of the prized copper mines on their own, there’d be a queue of potential bidders. BHP couldn’t be surprised by such a development either: if you make a proposal that amounts to “we’d like to buy you, except for the bits we don’t like”, others are free to riff on the idea.

More here:

Some of Anglo American’s largest shareholders should be pleased by today’s rejection of BHP Group’s offer.

Yesterday, Legal & General Investment Management (Anglo’s 11th largest shareholder) criticised BHP Group’s approach was “highly opportunistic” and “unattractive”.

Another investor, Redwheel, argued that the details of BHP’s proposal were “sketchy” and “rather opportunistic”, in view of recent weakness in Anglo’s share price.

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Miner Anglo American has rebuffed a takeover proposal from its larger rival BHP Group, declaring that the £31.1bn offer is “opportunistic” and “significantly” too low.

A day after the mining sector was shaken up by BHP’s approach, Anglo’s board has unanimously rejected the proposal.

The company says:

The Board has considered the Proposal with its advisers and concluded that the Proposal significantly undervalues Anglo American and its future prospects.

It gives several reasons: not only is the offer too low, but Anglo isn’t impressed by the structure of BHP’s all-share proposal, citing uncertainty and complexity, and “significant execution risks”.

Under BHP’s plan, Anglo would demerge its entire shareholdings in Anglo American Platinum Limited and Kumba Iron Ore Limited to its shareholders first, before being acquired, as BHP is mainly interested in its copper mines.

Announcing the rejection of BHP’s approach, Stuart Chambers, chairman of Anglo American, tells the City:

“Anglo American is well positioned to create significant value from its portfolio of high quality assets that are well aligned with the energy transition and other major demand trends.

With copper representing 30% of Anglo American’s total production, and with the benefit of well-sequenced and value-accretive growth options in copper and other structurally attractive products, the Board believes that Anglo American’s shareholders stand to benefit from what we expect to be significant value appreciation as the full impact of those trends materialises.

Chambers adds that Anglo American is “entirely focused” on delivering its strategic priorities.

The company owns mines in countries including Chile, South Africa, Brazil and Australia, but a series of missteps – including disappointing production rates last year – have left it vulnerable to a takeover approach.

But some analysts have already suggested that BHP might have to improve its offer, or that other bidders could also enter the fray with their own proposals….

Yesterday, Anglo’s shares surged 16% and closed slightly higher than BHP’s offer (which is worth £25.08 per share). That implies the City expected the initial proposal to be rebuffed.

Jamie Maddock, energy analyst at Quilter Cheviot, said:

The fact that the shares are trading just above what BHP is offering suggests one of two things – either BHP is going to up its offer or sweeten the deal in some way, or a second offer comes forward from another diversified miner like Glencore.

The deal premium feels relatively low, particularly in the context of recent M&A offers and the heightened complexity hence something above £30 per share could be likely to get it done.

The agenda

7.45am BST: French consumer confidence report for April

9.30am BST: UK insolvency statistics for March

11.30am BST: Bank of Russia interest rate decision

1.30pm BST: PCE measure of US inflation index for March

3pm BST: University of Michigan indx of US consumer confidence

https://news.google.com/rss/articles/CBMimQFodHRwczovL3d3dy50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDI0L2Fwci8yNi9hbmdsby1hbWVyaWNhbi1yZWplY3RzLWJocC10YWtlb3Zlci1taW5pbmctY29wcGVyLXVrLWNvbnN1bWVyLWNvbmZpZGVuY2UtaW5zb2x2ZW5jaWVzLWJ1c2luZXNzLWxpdmXSAZkBaHR0cHM6Ly9hbXAudGhlZ3VhcmRpYW4uY29tL2J1c2luZXNzL2xpdmUvMjAyNC9hcHIvMjYvYW5nbG8tYW1lcmljYW4tcmVqZWN0cy1iaHAtdGFrZW92ZXItbWluaW5nLWNvcHBlci11ay1jb25zdW1lci1jb25maWRlbmNlLWluc29sdmVuY2llcy1idXNpbmVzcy1saXZl?oc=5

2024-04-26 06:30:00Z

CBMimQFodHRwczovL3d3dy50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDI0L2Fwci8yNi9hbmdsby1hbWVyaWNhbi1yZWplY3RzLWJocC10YWtlb3Zlci1taW5pbmctY29wcGVyLXVrLWNvbnN1bWVyLWNvbmZpZGVuY2UtaW5zb2x2ZW5jaWVzLWJ1c2luZXNzLWxpdmXSAZkBaHR0cHM6Ly9hbXAudGhlZ3VhcmRpYW4uY29tL2J1c2luZXNzL2xpdmUvMjAyNC9hcHIvMjYvYW5nbG8tYW1lcmljYW4tcmVqZWN0cy1iaHAtdGFrZW92ZXItbWluaW5nLWNvcHBlci11ay1jb25zdW1lci1jb25maWRlbmNlLWluc29sdmVuY2llcy1idXNpbmVzcy1saXZl

Tidak ada komentar:

Posting Komentar