Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK retailers struggled through January as cost of living pressures continued to hit consumers.

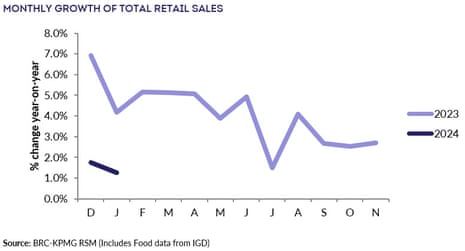

Spending in the shops rose by just 1.2% year-on-year in January, a sharp slowdown on the 4.2% recorded in January 2023, new data from the British Retail Consortium shows.

With inflation running at 4% in December, that indicates a drop in sales volumes.

The BRC also reports that people cut back on non-food items, with spending falling by 1.8% in the three months to January

Food sales increased 6.3% year on year over the three months to January, slower than the 8% growth in January 2023.

Helen Dickinson OBE, chief executive of the British Retail Consortium, says:

“Easing inflation and weak consumer demand led retail sales growth to slow. While the January sales helped to boost spending in the first two weeks, this did not sustain throughout the month.

Larger purchases, such as furniture, household appliances, and electricals, remained weak as the higher cost of living continued into its third year.

Households on low incomes will start to receive a £299 cost-of-living payment today – the last of three payments totalling up to £900 paid to eligible households on means-tested benefits over 2023/24.

Separate figures from Barclays this morning have confirmed spending was weak last month: consumer card spending grew 3.1% year on year in January – below the current headline rate of inflation of 4%.

Also coming up today

The US dollar is trading at a 12-week high, as hopes of an early cut to US interest rates fade.

This has pushed the pound down to $1.2515 last night, its lowest level of the year.

We get the latest healthcheck on the UK and eurozone construction sectors this morning, along with eurozone retail sales figures.

The agenda

7am GMT: German factory orders for December

8.30am GMT: Eurozone construction PMI for January

9.30am GMT: UK construction PMI for January

10am GMT: Eurozone retail sales for December

3pm GMT: RealClearMarkets/TIPP index of US economic optimism

Filters BETA

Construction activity in Europe’s two largest economies was weak at the start of this year, new data shows.

Data firm S&P Global reports that French construction activity declined at the sharpest rate for three years in January.

S&P Global says:

France’s construction sector remained mired in a deep downturn at the start of 2024, with the contraction in total activity worsening further to its sharpest for three years.

Work carried out on all types of building projects fell in January, with housing and commercial construction activity exhibiting especially-notable slumps. The outlook was gloomy, with business confidence staying subdued amid a further rapid reduction in new orders.

While in Germany, the construction sector remained stuck in a slump at start of 2024, with a sustained sharp downturn in building activity in January.

S&P Global says:

Weakness remained centred on the [German] housing sector, while civil engineering showed greater resilience. With new orders continuing to fall sharply and firms maintaining a negative outlook for future activity, there were further job losses across the sector in January.

Although BP’s profits halved last year, it still made its second-highest earnings in the last decade.

BP’s $13.8bn profits in 2023 reported this morning are dwarfed by the whopping $27.7bn it made in 2022, thanks to soaring oil and gas prices. But they’re above the $12.8bn made in 2021.

In 2020 BP made a loss of $5.7bn, when the Covid-19 pandemic hit energy demand, and you have to go back to 2012, when BP’s annual profits were $17.1bn, for a higher number than last year (excluding 2022).

In the financial markets, shares in China have jumped as hopes build that Beijing will take more forceful action to stem the recent stock rout.

The CSI 300 index of leading Chinese stocks has jumped by 3.5%, while Hong Kong’s Hang Seng is up 4%.

The rally came after Bloomberg reported that regulators plan to brief President Xi Jinping on market conditions and the latest policy initiatives as soon as today.

Kathleen Brooks, research director at XTB, says:

There has been a boost to market sentiment on Tuesday after a strong bounce back for Chinese shares. The Shenzhen Index rose by more than 6% on Tuesday and the Hang Seng was higher by 4% after the Chinese government put more pressure on institutions to actively buy Chinese stocks.

How long this will last, we shall have to see, as it may not be a long-term solution to China’s share price decline, but for now this is helping to boost market sentiment and US futures are also pointing to a higher open in the US later today.

Stocks in Europe are also higher, with the FTSE 100 index up 55 points or 0.75% at 7,668 points.

German industrial orders have unexpectedly jumped, bringing some relief to Europe’s largest economy.

Factory orders jumped by 8.9% in December, Germany’s federal statistics office reports, beating expectations that orders would remain flat.

There were a very high volume of large-scale orders in a range of branches, including an “exceptionally large number of aircraft” being ordered.

There were also more large-scale orders for fabricated metal products and electrical equipment, which made up for a drop in orders for new cars, machinery and equipment, and chemicals.

BP’s shares are now up 6.6%, at the highest since the end of November, as investors welcome its plan to buy back more shares, after beating profits in the last quarter.

BP has a ricky balancing act ahead, says John Moore, senior investment manager at RBC Brewin Dolphin:

BP has beaten expectations for the final quarter of 2023, but fallen slightly short for the year. The company went through a significant amount of change last year and this, combined with a declining oil price, has had an impact on overall performance.

Nevertheless, BP is still in resilient shape – surplus cashflow remains positive, net debt has fallen, and the management team’s optimism can be seen in the 10% increase in dividend distributions. Questions have been raised over its future direction and BP will need to strike a tricky balance of continuing to invest in its core energy business to deliver returns in the short term, while maintaining its long-term transformation.”

Shares in BP have jumped almost 5% at the start of trading in London.

They’re up 21p to 475p, a one-month high.

January was a harsh reality check for the retail sector, reports Victoria Scholar, head of investment at interactive investor, as shown by like-for-like sales growth falling from 1.9% in December to 1.4% last month.

The excitement of Christmas quickly faded with consumers tightening their purse strings to mark the beginning of a new year and the end of the festive splurge. While 2024 may be the year that interest rate cuts kick in and real incomes grow, consumers are still grappling with much higher prices than they were a few years ago and higher mortgage payments on top. That’s leading to lower consumer confidence and less spending in the economy including on discretionary retail items.

A two-speed retail sector has been emerging, separating the winners from the losers in the UK with luxury and certain discretionary retailers struggling amid the macroeconomic headwinds while supermarkets like Tesco continue to thrive despite intense price competition. Looking ahead, the threat of supply chain disruptions, product delays and shortages following the attacks in the Red Sea is an overhang to watch for the sector.”

BP delivered a “strong” underlying financial performance in 2023, insists CFO Kate Thomson.

Thomson explains:

We raised dividend per ordinary share by 10% and bought back $7.9bn of shares. We remain focused on strengthening the balance sheet, with net debt falling to $20.9bn, the lowest level over the past decade.

As we look forward, we are staying disciplined, tightening our capital expenditure frame and simplifying and enhancing our share buyback guidance through 2025.

Mathew Lawrence, director of the thinktank Common Wealth, says BP’s financial results show Big Oil cannot be trusted to deliver a clean energy future.

Lawrence

The fossil fuel giants cannot unhook themselves from their planet-destroying business model.

Doubling down on oil and gas investment guarantees deepening climate crisis and volatile, eye-watering energy bills. And while the sums for renewables investment are pitiful, they have still found billions to reward their investors.

Damaging as these outcomes are, they are the inevitable outcome of their climate-hostile business model. Real change requires ending the primacy of the for-profit model in who – and how – we organise the energy transition.”

BP says it plans to make share buybacks of at least $14bn by the end of 2025, as part of its policy of returning at least 80% of surplus cash flow to shareholders.

That implies quarterly buybacks of at least $1.75bn, up from the $1.5bn in the final quarter of 2023.

Share buybacks are a way of returning cash to investors – it pushes up the share price, and means dividends can be higher as the pot is split between a smaller number of shares.

But they’re also controversial – surely BP could find a better use for the money?

Joseph Evans, researcher at IPPR, says:

“BP has decided to prioritise its shareholders over investing in the green transition. With profits down on last year, you might expect BP’s executives to be looking for profitable investments in the growing industries of the future, like renewable energy. Instead, they’ve chosen to enrich their investors.

“It’s clear that BP and other fossil-fuel giants can’t be trusted to drive the green transition: they will always prioritise their shareholders over the needs of the economy and the planet. What we need now is a large programme of public investment in renewables and net zero. The government could fund that investment by taxing the excessive pay-outs that BP and other energy giants are handing to their shareholders.”

Global Witness report that BP’s shareholder payouts rose to £10.2bn last year.

Jonathan Noronha-Gant, Global Witness senior campaigner, says BP’s shareholders remain among the biggest winners of Russia’s war in Ukraine (which pushed up oil and gas prices in 2022).

“Shareholders should want to protect their long-term positions. That means demanding a rapid clean energy transition for companies like BP. These reckless shareholder pay-outs do the opposite.”

“As millions of struggling households begin to receive their cost-of-living payments today, BP’s shareholders, in contrast, celebrate with an eye-watering payout. BP is making huge profits off the back of a cost-of-living and energy crisis that has devastated the finances of so many in the UK and around the globe.”

BP’s drop in profits was partly due to weaker refining profit margins.

The company says there were “significantly lower industry refining margins” in the last quarter, due to narrowing prices for North American heavy crude oil differentials.

Oil giant BP has beaten profit forecasts this morning, despite a drop in earnings.

BP made adjusted earnings of almost $3bn in the final quarter of 2023, ahead of expectations of $2.76bn, but down on the $4.8bn profits made in Q4 2022 when energy prices were higher.

For the full year, BP’s profits roughly halved to $13.8bn from $27.6bn in 2022.

BP will continue to pump money back to shareholders; it has announced a new $1.75bn share buyback – larger than the $1.5bn it executed in the last quarter – and is committed to $3.5bn worth of buybacks for the first half of this year.

Murray Auchincloss, BP’s CEO, says the company is pressing on with changing from an international oil company (IOC) to an integrated energy company (IEC).

Auchincloss explains:

Looking back, 2023 was a year of strong operational performance with real momentum in delivery right across the business.

And as we look ahead, our destination remains unchanged - from IOC to IEC - focused on growing the value of bp. We are confident in our strategy, on delivering as a simpler, more focused and higher-value company, and committed to growing long-term value for our shareholders.

Looking back, 2023 was also the year in which Auchincloss took on the top job at BP, after former CEO Bernard Looney failed to fully report details of relationships with colleagues.

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK retailers struggled through January as cost of living pressures continued to hit consumers.

Spending in the shops rose by just 1.2% year-on-year in January, a sharp slowdown on the 4.2% recorded in January 2023, new data from the British Retail Consortium shows.

With inflation running at 4% in December, that indicates a drop in sales volumes.

The BRC also reports that people cut back on non-food items, with spending falling by 1.8% in the three months to January

Food sales increased 6.3% year on year over the three months to January, slower than the 8% growth in January 2023.

Helen Dickinson OBE, chief executive of the British Retail Consortium, says:

“Easing inflation and weak consumer demand led retail sales growth to slow. While the January sales helped to boost spending in the first two weeks, this did not sustain throughout the month.

Larger purchases, such as furniture, household appliances, and electricals, remained weak as the higher cost of living continued into its third year.

Households on low incomes will start to receive a £299 cost-of-living payment today – the last of three payments totalling up to £900 paid to eligible households on means-tested benefits over 2023/24.

Separate figures from Barclays this morning have confirmed spending was weak last month: consumer card spending grew 3.1% year on year in January – below the current headline rate of inflation of 4%.

Also coming up today

The US dollar is trading at a 12-week high, as hopes of an early cut to US interest rates fade.

This has pushed the pound down to $1.2515 last night, its lowest level of the year.

We get the latest healthcheck on the UK and eurozone construction sectors this morning, along with eurozone retail sales figures.

The agenda

7am GMT: German factory orders for December

8.30am GMT: Eurozone construction PMI for January

9.30am GMT: UK construction PMI for January

10am GMT: Eurozone retail sales for December

3pm GMT: RealClearMarkets/TIPP index of US economic optimism

https://news.google.com/rss/articles/CBMilAFodHRwczovL3d3dy50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDI0L2ZlYi8wNi9yZXRhaWwtc2FsZXMtc2xvdy1jb3N0LW9mLWxpdmluZy1icC1wcm9maXRzLWNvbnN0cnVjdGlvbi1wbWktY2hpbmEtc3RvY2stbWFya2V0cy1idXNpbmVzcy1saXZl0gGUAWh0dHBzOi8vYW1wLnRoZWd1YXJkaWFuLmNvbS9idXNpbmVzcy9saXZlLzIwMjQvZmViLzA2L3JldGFpbC1zYWxlcy1zbG93LWNvc3Qtb2YtbGl2aW5nLWJwLXByb2ZpdHMtY29uc3RydWN0aW9uLXBtaS1jaGluYS1zdG9jay1tYXJrZXRzLWJ1c2luZXNzLWxpdmU?oc=5

2024-02-06 07:27:13Z

CBMilAFodHRwczovL3d3dy50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDI0L2ZlYi8wNi9yZXRhaWwtc2FsZXMtc2xvdy1jb3N0LW9mLWxpdmluZy1icC1wcm9maXRzLWNvbnN0cnVjdGlvbi1wbWktY2hpbmEtc3RvY2stbWFya2V0cy1idXNpbmVzcy1saXZl0gGUAWh0dHBzOi8vYW1wLnRoZWd1YXJkaWFuLmNvbS9idXNpbmVzcy9saXZlLzIwMjQvZmViLzA2L3JldGFpbC1zYWxlcy1zbG93LWNvc3Qtb2YtbGl2aW5nLWJwLXByb2ZpdHMtY29uc3RydWN0aW9uLXBtaS1jaGluYS1zdG9jay1tYXJrZXRzLWJ1c2luZXNzLWxpdmU

Tidak ada komentar:

Posting Komentar