Filters BETA

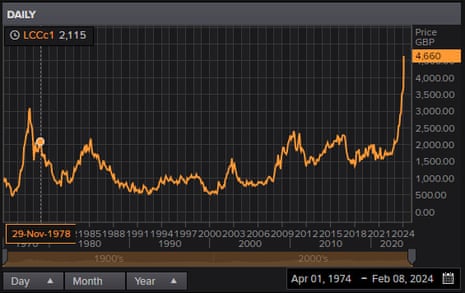

Bad weather in West Africa have driven cocoa prices to record highs this week

Benchmark London cocoa futures hit a record £4,670 a metric ton yesterday, up over 7% – and have roughly doubled since the start of last year.

West Africa is home to three quarters of the world’s production, but its cocoa crop has been hit by strong Harmattan winds – very dry and strong winds which blow from the Sahara region towards the West of Africa.

Last night, chocolate maker Hershey warned that ‘historic’ cocoa inflation could push prices higher.

Hershey’s CEO Michele Buck told analysts:

“We can’t talk about future pricing [but] given where cocoa prices are, we will be using every tool in our toolbox, including pricing, as a way to manage the business.”

UK housebuilder Bellway has reported that falling mortgate rates has spurred demand.

It told the City this morning that reservations in January were higher than a year ago:

The reduction in mortgage interest rates throughout the first half has led to encouraging levels of customer enquiries in the traditionally quieter winter trading period, and an improvement in the private reservation rate during January to 0.59 per outlet per week (January 2023 - 0.45).

Bellway also reported a 28% drop in housing completions in the six months to the end of January, to 4,092 homes. This knocked its revenues down to £1.25bn, from £1.8bn a year earlier.

The company says it is on track to build 7,500 homes this financial year (to the end of July), down from almost 11,000 in the 12 months to 31 July 2023, adding:

The economic outlook has improved through the period, although the Board is mindful of future risks to customer demand and cost inflation, particularly from ongoing geopolitical tensions. Against this backdrop, we will retain a clear focus on maintaining balance sheet resilience.

Rising energy prices risk complicating the Bank of England’s journey towards cutting interest rates.

The price of Brent crude has climbed from $77.33 a barrel last Friday night to $81.50 this morning, in a week in which Israel rejected the terms of a ceasefire in Gaza proposed by Hamas, insisting victory was “within reach”

January’s UK inflation report, due next Wednesday, will influence how soon the Bank of England might start to cut interest rates.

The annual consumer prices index is expected to have risen slightly last month, reports Sanjay Raja, Deutsche Bank’s chief UK economist:

After headline inflation surprised to the upside in December, we expect a further – albeit marginal – jump in inflationary pressure. Headline CPI in January will likely start the year at 4.1% y-o-y, lifted in large part by positive base effects. Core CPI, we think, will settle at 5.0% y-o-y – dragged lower by core goods inflation. And we see services CPI inching higher to 6.6% y-o-y. For RPI, we see headline inflation staying put at 5.1% y-o-y.

Risks to our forecast? Tilted to the upside. Indeed, weight changes for CPI will add another layer of complexity to our inflation projections. And given volatile moves in catering, travel, and package holidays in general, we could see services prices come in a little stronger than our baseline projections.

Jonathan Haskel also pointed out that the UK has suffered a series of shocks since he joined the BoE in 2018:

“I guess the second thing is ... it’s been a turbulent six years and a lot of ups and downs and Brexit, (the pandemic), Liz Truss and all that kind of thing. I’ve got to say the economy, in some ways, has been amazingly resilient.

“Relative to that magnitude of shocks, we’ve navigated our way through all of this.”

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

A week on from leaving UK interest rates on hold, Bank of England policymakers have been scrambling to explain their votes, and hint what might make them change their mind.

And this morning Jonathan Haskel, one of two Monetary Policy Committee members who voted to raise rates last week, has said he wants to seee more evidence that inflationary pressures are cooling.

In an interview with Reuters, Haskel says:

“The signs that we’ve seen thus far are encouraging. I don’t think we’ve seen quite enough signs yet.

But if we accumulate more evidence on persistence, then by the very logic I’ve just set out, I’d be happy to change my vote.”

Haskel revealed that his vote last week, to raise interest rates to 5.25%, was “finely balanced” – perhaps a sign that he could soften his position, if inflation pressures softened first.

But he insisted it was right to worry about inflation becoming embedded, telling Reuters:

“I’m not going to apologise for banging on about persistence because I think we’re right to.”

The BoE left rates on hold at 5.25% in a rare three-way split, with six policymakers voting for no change, and one – Swati Dhingra – pushing for a cut.

Haskel’s fellow hawk, Catherine Mann, revealed yesterday that her vote was “finely balanced” , but also cited risks of “continued inflation momentum and embedded persistence”.

Mann also warned that attacks on cargo ships in the Red Sea could create an “upward inflation shock”, driving up goods prices – and meaning services inflation – notoriously sticky – would need to fall further before rates should fall.

But high interest rates suppresses activity and slows the economy. Earlier this week, Dhingra argued that weak consumer spending and declining inflation means the Bank should have cut rates last week.

The Bank forecast that inflation will drop to its 2% target this spring, down from 4% in December, but will rise again later this year.

The City expects at least three interest rate cuts this year, bringing Bank rate down to 4.5% by the end of 2024.

The agenda

7am GMT: German inflation report for January

9am GMT: Italian industrial production report for December

4pm GMT: Russia’s GDP report for December

https://news.google.com/rss/articles/CBMieWh0dHBzOi8vd3d3LnRoZWd1YXJkaWFuLmNvbS9idXNpbmVzcy9saXZlLzIwMjQvZmViLzA5L2Jhbmstb2YtZW5nbGFuZC1oYXNrZWwtaW5mbGF0aW9uLXJpc2tzLWludGVyZXN0LXJhdGVzLWJ1c2luZXNzLWxpdmXSAXlodHRwczovL2FtcC50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDI0L2ZlYi8wOS9iYW5rLW9mLWVuZ2xhbmQtaGFza2VsLWluZmxhdGlvbi1yaXNrcy1pbnRlcmVzdC1yYXRlcy1idXNpbmVzcy1saXZl?oc=5

2024-02-09 07:32:16Z

CBMieWh0dHBzOi8vd3d3LnRoZWd1YXJkaWFuLmNvbS9idXNpbmVzcy9saXZlLzIwMjQvZmViLzA5L2Jhbmstb2YtZW5nbGFuZC1oYXNrZWwtaW5mbGF0aW9uLXJpc2tzLWludGVyZXN0LXJhdGVzLWJ1c2luZXNzLWxpdmXSAXlodHRwczovL2FtcC50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvbGl2ZS8yMDI0L2ZlYi8wOS9iYW5rLW9mLWVuZ2xhbmQtaGFza2VsLWluZmxhdGlvbi1yaXNrcy1pbnRlcmVzdC1yYXRlcy1idXNpbmVzcy1saXZl

Tidak ada komentar:

Posting Komentar