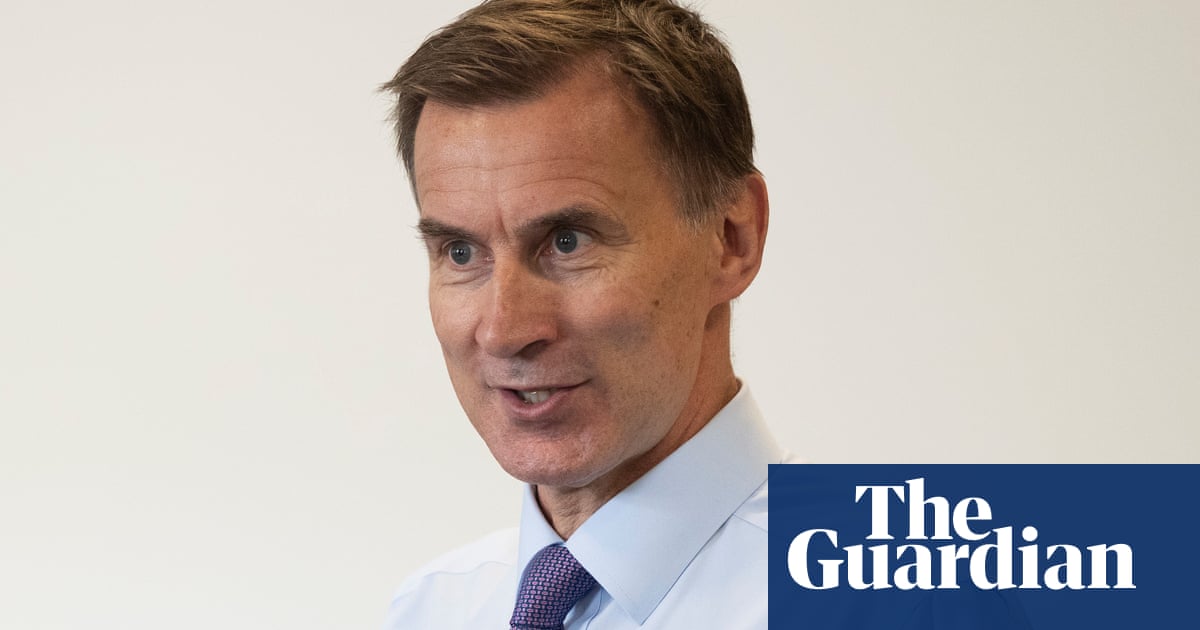

Jeremy Hunt has warned that the high pace of inflation in Britain will prevent pre-election tax cuts this autumn amid signals from the Bank of England that another rate rise to ease cost of living pressures is coming next week.

Speaking in India, the chancellor said he would be wary of putting money into the pockets of consumers in his November package because of the danger that it would overstimulate the economy and make it more difficult for Threadneedle Street to bring inflation down.

“When you’re trying to bring down inflation, you have to be really careful not to pump extra money into the economy, as much as you would like to – not to pump extra money into people’s pockets – because that can push up prices and keep inflation higher for longer,” Hunt said in an interview with Bloomberg TV.

He said money would be tight in any event because of the impact of higher inflation and rising interest rates on the government’s debt interest payments, but added: “The one thing I can absolutely say is that our focus in the autumn statement will be on bringing down inflation and delivering the prime minister’s goal to halve inflation and the Bank of England’s target to get it down to 2%.”

The chancellor’s comments came as Catherine Mann, one of the nine members of the Bank’s rate-setting monetary policy committee said she would be prepared to cause damage to the economy by raising interest rates too far rather than take the risk of allowing inflation to become embedded.

Mann said she would prefer to err on the side of tightening too much because there was a danger doing too little would result in a persistent cost of living problem that would eventually require even tougher measures to cure.

In a speech to be given to the Canadian Association for Business Economics on Tuesday, Mann will signal that she plans to vote for the Bank to raise interest rates for a 15th successive time when it meets next week. Financial markets are expecting a quarter-point increase to 5.5%.

“To pause or to hold the policy rate lower for longer risks inflation becoming more deeply embedded, which would then require more tightening in total, to both change inflation itself and to wring out the embedded inflation that comes from the sustained duration above target. This is why I would rather err on the side of overtightening,” Mann was due to say.

The Bank needed to send out a clear message that it would do whatever necessary to bring the annual inflation rate – currently 6.8% – back to its official 2% target “sooner rather than later”.

Mann has tended to be one of the more hawkish members of the MPC since it started to raise interest rates from the record low of 0.1% in December 2021.

She said there was a risk that the Bank might be tough and too soft in its approach to interest rates.

“Which mistake would I rather make and do the data and analysis help me in that judgment? At issue in the current conjuncture, and speaking just for myself, the risk of tightening too little is more salient.”

The Bank would itself contribute to the overshoot of the inflation target if it underestimated the rise in the persistent component of inflation and set policy consistent with a world that “may no longer exist”, Mann said. “And the longer this overshoot is allowed to continue, the more likely a departure from the old ‘low inflation, low volatility’ steady state.”

https://news.google.com/rss/articles/CBMigQFodHRwczovL3d3dy50aGVndWFyZGlhbi5jb20vYnVzaW5lc3MvMjAyMy9zZXAvMTEvaGlnaC11ay1pbmZsYXRpb24tbWFrZXMtYXV0dW1uLXRheC1jdXRzLXVubGlrZWx5LXNheXMtamVyZW15LWh1bnQtaW50ZXJlc3QtcmF0ZXPSAYEBaHR0cHM6Ly9hbXAudGhlZ3VhcmRpYW4uY29tL2J1c2luZXNzLzIwMjMvc2VwLzExL2hpZ2gtdWstaW5mbGF0aW9uLW1ha2VzLWF1dHVtbi10YXgtY3V0cy11bmxpa2VseS1zYXlzLWplcmVteS1odW50LWludGVyZXN0LXJhdGVz?oc=5

2023-09-12 01:31:00Z

2379358646

Tidak ada komentar:

Posting Komentar