The London Metal Exchange suspended trading in one of its main contracts after a vicious “short squeeze” sent the price of nickel soaring and left a Chinese metals tycoon facing billions of dollars in potential losses.

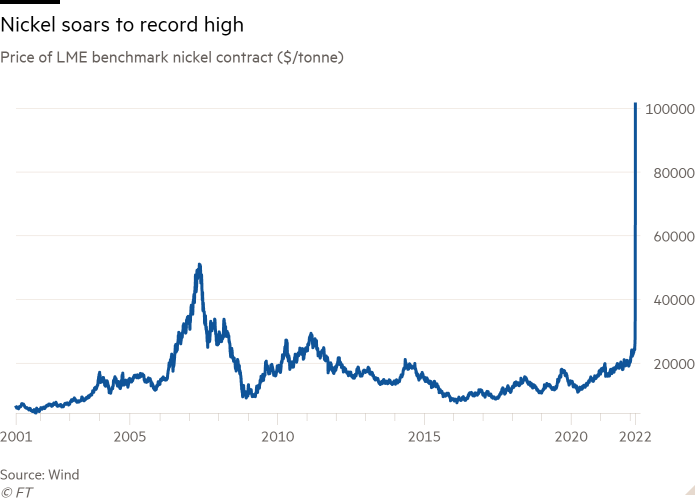

Nickel prices doubled on Tuesday and briefly rose above a record $100,000 a tonne as banks and brokers rushed to close part of a huge position amassed by Xiang Guangda, the billionaire founder of China’s leading stainless steel producer Tsingshan Holding Group. It later pulled back closer to $80,000.

Xiang had bet that the price of nickel would fall, but when the market moved sharply the other way, he would have been required to either post more cash to cover his losses or buy back the position.

The move on Tuesday followed a jump of more than 70 per cent in the previous session as rumours about the size of Xiang’s position swirled around London’s tight-knit metals market.

The size of Xiang’s short position is unclear but it is at least 100,000 tonnes of nickel, according to people with familiar with the matter, who said the LME had been forced to act when it became clear that some of its small members were also facing large demands for extra cash to cover trades put on for clients.

Several market participants said Xiang faced potential losses stretching into billions of dollars given the size of the trade, but that the figure could change depending on where nickel prices reopen.

LME, which is owned by Hong Kong Exchanges and Clearing, said it had taken the decision to halt trading on “orderly market grounds” and warned that it was considering a closure of several days.

“The LME will actively plan for the reopening of the nickel market, and will announce the mechanics of this to the market as soon as possible,” it said.

Nickel’s main use is to make stainless steel, but the fastest-growing market for use of the metal is in the batteries that power electric vehicles. The LME contract is for high-grade metal prized by carmakers.

The decision to suspend dealings and cancel all trades made on Tuesday is the biggest crisis at the 145-year-old exchange since a rogue trader at Japan’s Sumitomo Corporation racked up huge losses in the 1990s trying to corner the copper market.

Unlike most futures exchanges, the LME’s contracts can be settled physically from metal that sits in its network of approved warehouses, which stretch from Rotterdam to Malaysia.

This link makes the exchange the leading price setter for industrial metals. Its customers include physical producers and big industrial consumers of metal seeking to hedge their exposure to price moves.

Colin Hamilton, analyst at BMO Capital Markets, said it was surprising the LME had let “someone build a short position” in excess of available inventory. “To have such a large short position when there isn’t enough inventory to deliver against it is exchange 101,” he said. “That shouldn’t happen.”

In a statement to local Chinese media, Xiang said Tsingshan did not have any problems with its nickel position or its operations. “Today, we’ve received lots of phone calls and the relevant state departments and leaders have shown their support to Tsingshan,” he said.

However, people with knowledge of the situation said the LME on Monday had given one of Xiang’s brokers extra time to meet a margin call — a demand for extra cash to cover a position.

Privately owned Tsingshan, which is based in eastern China, has emerged from relative obscurity to become the world’s biggest producer of stainless steel. It was also one of the Chinese companies that helped drive the adoption of nickel pig iron — a low-cost alternative to refined nickel — and now wants to build a presence in battery-grade nickel.

Nickel prices picked up at the end of last year because of demand from carmakers but started to really accelerate last week on fears that supplies from Russia could be disrupted.

Russia is the biggest producer of high-grade nickel, responsible for about 12 per cent of global supply, according to Morgan Stanley.

“Part of Tsingshan’s problem is they produce the wrong type of nickel. They can’t deliver against the LME contract, ” said Hamilton.

Traders said the LME would need to find a way to close Xiang’s short before trading resumed, otherwise it would find itself in the same position with prices spiralling out of control.

The LME’s outgoing chief executive Matt Chamberlain has pushed for more regulation to prevent squeezes but his plans have been rejected by its members.

Additional reporting by Philip Stafford and Eleanor Olcott

https://news.google.com/__i/rss/rd/articles/CBMiP2h0dHBzOi8vd3d3LmZ0LmNvbS9jb250ZW50LzAyNjljZGRhLWVmNjctNDNjOC1iODIwLWE5MTljOTE5YjVmYdIBAA?oc=5

2022-03-08 15:50:56Z

1273114925

Tidak ada komentar:

Posting Komentar