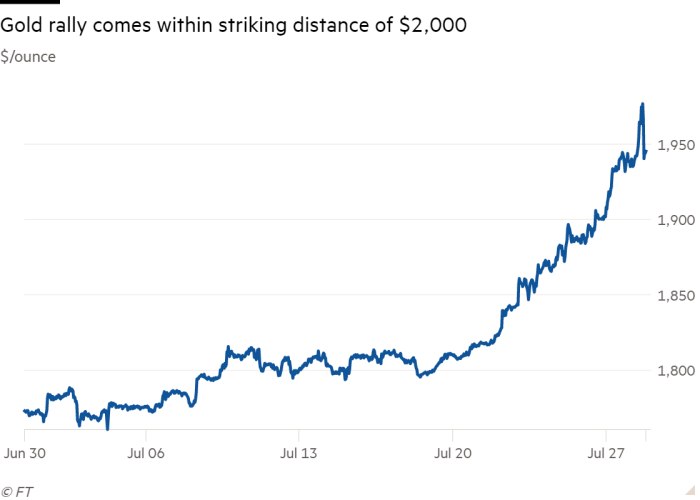

Gold rose to within striking distance of $2,000 for the first time as investors brace themselves for a period of low returns from other assets such as bonds and the US dollar sinks to multiyear lows.

The price of the precious metal for immediate delivery increased as much as 2 per cent to hit a new all-time high of $1,980.57 per troy ounce on Tuesday morning in Asia, before shedding much of that gain. Gold has risen more than 30 per cent in the year to date, making it one of the best-performing mainstream assets of 2020.

Silver also rose as much as 6.4 per cent to $26.19 per ounce during the Asian session, before easing back to trade 0.7 per cent higher.

Viewed by investors as a haven during times of uncertainty, gold has jumped about 9 per cent in the past six trading sessions as concerns have grown over the economic impact of US coronavirus outbreaks.

The recent gains have come at the expense of the dollar as investors have bet that the worsening Covid-19 situation in the US will prompt more economic stimulus measures. A weaker dollar is typically viewed as bullish for gold partly because it makes the metal cheaper for international buyers.

The dollar index, which tracks the US currency against a basket of peers, edged 0.3 per cent higher but continued to trade near its lowest levels since mid-2018. The index has fallen 6 per cent since early May.

Investors said gold’s upward momentum reflected growing expectations that the Federal Reserve could signal new policy measures when its rate-setting committee meets on Wednesday.

While traders generally doubt the Fed will turn to negative interest rates, some believe it could adopt more unconventional measures such as yield curve control or setting upper limits on Treasury yields.

“The Fed is likely to signal it continues to have its finger on the trigger — that it stands ready to ease policy more if necessary,” said Thomas Costerg, senior US economist at Pictet Wealth Management.

Negative returns for US and other government bonds, after accounting for inflation, has boosted the allure of gold, which is considered to be a store of value and a hedge against future inflation.

Others pointed to the fact that the coronavirus had made obtaining physical gold more difficult, also helping to push up prices.

“Anyone involved in the physical market would be aware of the fact that at the dealer level, access, particularly to gold and silver coins, has been curtailed as a result of the virus,” said Robert Rennie, global head of market strategy at Westpac.

In London, the FTSE 100 opened 0.7 per cent higher, propelled upwards by energy stocks that investors hope will benefit from more US stimulus to battle the coronavirus pandemic. The Europe Stoxx 600 index rose 0.2 per cent, Germany’s Dax gained 0.4 per cent and France’s CAC lost 0.2 per cent.

This followed a mixed session in Asia. China’s CSI 300 index of Shanghai and Shenzhen-listed stocks climbed 0.5 per cent while Hong Kong’s Hang Seng rose 0.4 per cent. Japan’s benchmark Topix shed 0.5 per cent.

Futures tipped Wall Street’s S&P 500 to rise 0.1 per cent when trading begins later.

https://news.google.com/__i/rss/rd/articles/CBMiP2h0dHBzOi8vd3d3LmZ0LmNvbS9jb250ZW50L2E2OTM2N2U4LTE3MzAtNDgzNi05ZjE0LTBjMjBkNjE1ZTAwNtIBP2h0dHBzOi8vYW1wLmZ0LmNvbS9jb250ZW50L2E2OTM2N2U4LTE3MzAtNDgzNi05ZjE0LTBjMjBkNjE1ZTAwNg?oc=5

2020-07-28 07:55:00Z

52780955870849

Tidak ada komentar:

Posting Komentar