© Reuters.

© Reuters.

By Geoffrey Smith

Investing.com -- China's president signaled there'll be no let-up in the pursuit of growth this year, in an editorial some took as an augury of future stimulus measures. China's stock market erased what was left of its pre-holiday losses as a result, dragging European ones to new record highs, amidst further signs that China is returning to work (and play). The U.S.'s stock markets are closed for Presidents Day, meanwhile. GM shrunk its global presence further, announcing a withdrawal from Australia, New Zealand and Thailand. Japan's economy shrunk badly in Q4, while Thailand and Singapore cut their growth forecasts. And Alstom (PA:) said it was in talks with Bombardier over creating a new rail giant. Here's what you need to know in financial markets on Monday, February 17th.

1. Xi hints at stimulus

Chinese President Xi Jinping hinted at fresh stimulus measures for the Chinese economy as business and banks continue to struggle with the effects of the Covid-19 outbreak.

Xi was quoted in a weekend editorial as saying that central and local governments “still need to deliver this year’s economic and social targets” for this year, targets that will likely be out of reach in the absence of further policy support.

Elsewhere the People’s Bank of China cut the rate on its medium-term financing facility by 10 basis points to 3.15%. Although that affects only some 200 billion yuan ($28.6 billion) directly, the facility is a reference rate for the Chinese interbank market.

Elsewhere, official Chinese data pointed to a further slowdown in the incidence of both deaths and new cases, and there were also upbeat anecdotal data points as Macau said casinos could reopen their doors from Thursday.

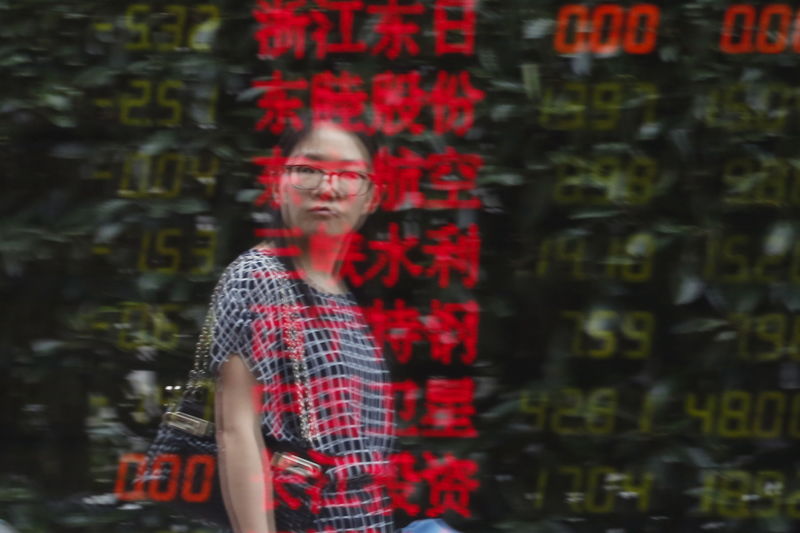

2. Chinese, European stocks move higher

Global stock markets responded to the latest news out of China with optimism. China’s index rose 2.3% to its highest level since before the extended New Year holiday.

Sentiment was also underpinned by the fact that the PBoC withdrew a net 700 billion yuan in liquidity from the market without major incident. The operation reversed the huge seasonal injection of cash made by the PBoC before the New Year holiday.

Around 300 billion of a total maturing volume of 1 trillion yuan was reinjected through seven-day reverse repos and the bank’s medium-term lending facility.

European stock markets followed China higher, with the benchmark rising 0.2% to a new record high and Italy’s rising 0.5%.

U.S. stock markets are closed on Monday for the President’s Day holiday.

3. Japan's Q4 GDP shock; Thailand, Singapore cut growth forecasts

Japan’s shrunk at an annualized pace of 6.3% in the fourth quarter of 2019, under the impact of a sales tax increase that came into effect in October, and the devastation of Typhoon Hagibis.

The numbers are the latest macro data to show the world economy in weak health even before the Covid-19 outbreak. Eurozone data published last week indicated the regional economy was nearly stagnant in the fourth quarter.

Elsewhere on Monday, Singapore and Thailand both cut their growth forecasts for 2020, citing virus-related impacts. The sudden stop to flows of Chinese tourists is expected to hit the Thai economy particularly hard.

4. GM pulls out of Australia, NZ, Thailand

General Motors' (NYSE:) withdrawal from less profitable markets around the world continued.

The company said it will wind down sales and manufacturing of its Holden brand in Australia by 2021, and will also withdraw the Chevrolet brand from Thailand by the end of this year.

The Detroit-based company, which has already largely withdrawn from Europe with the sale of its Opel and Vauxhall brands to PSA Group, said it expects $1.1 billion of restructuring costs.

5. Alstom's future back on the rails again

Alstom (PA:) stock hit a 10-year high after the French engineering group said it’s in talks to merge with the rail unit of Canada’s Bombardier (TSX:).

The announcement comes less than a year after the European Union Commission blocked its plans to merge with the rail business of Siemens on antitrust grounds. The French group has been desperately struggling for scale in the face of intense competition from China’s CRRC.

The news puts a fresh question mark over the fate of Siemens’ rail arm.

https://news.google.com/__i/rss/rd/articles/CBMiaWh0dHBzOi8vd3d3LmludmVzdGluZy5jb20vbmV3cy9lY29ub215L3RvcC01LXRoaW5ncy10by1rbm93LWluLXRoZS1tYXJrZXQtb24tbW9uZGF5LWZlYnJ1YXJ5LTE3dGgtMjA4NjQ4MdIBAA?oc=5

2020-02-17 11:32:00Z

CBMiaWh0dHBzOi8vd3d3LmludmVzdGluZy5jb20vbmV3cy9lY29ub215L3RvcC01LXRoaW5ncy10by1rbm93LWluLXRoZS1tYXJrZXQtb24tbW9uZGF5LWZlYnJ1YXJ5LTE3dGgtMjA4NjQ4MdIBAA

Tidak ada komentar:

Posting Komentar