![]()

China's banks face up to $1.1tn surge in questionable loans, S&P warns

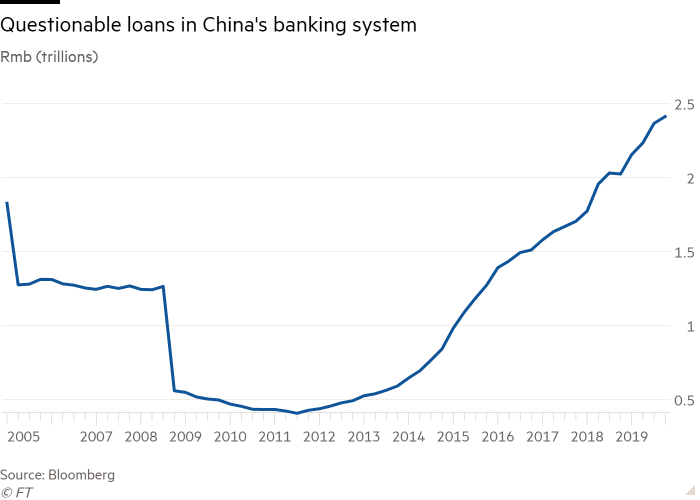

China's lenders may be hit with an increase of as much as Rmb7.7tn ($1.1tn) in questionable loans as the coronavirus outbreak deals a heavy blow to China's economy, S&P Global Ratings has warned.

The Covid-19 outbreak, which has prompted China to lock down large swaths of its sprawling economy, will cause some individuals and companies to "have difficulty with debt repayment," S&P said in a report issued on Thursday in Hong Kong.

In a worst-case scenario in which the outbreak does not peak until April, S&P forecasts China's economy, the second biggest in the world, will expand 4.4 per cent in 2020. That would mark a dramatic slowdown from the 6.1 per cent growth in 2019 and be the weakest pace since 1990, according to World Bank data.

S&P's base scenario, in which the virus peaks next month, points to 2020 growth of 5 per cent, which would also be the lowest in three decades. Even in the best case in which the virus peaks in February, GDP growth is forecast at 5.5 per cent.

The "growth shock" would cause the value of non-performing loans in China's banking sector to surge by Rmb7.7tn to Rmb10.1tn in S&P's worst-case scenario. In the base case, the figure would jump Rmb5.4tn to Rmb7.8tn. In the best case, the NPLs would rise Rmb3.4tn to Rmb5.8tn. The ratio of NPLs to total loans would be 7.8 per cent, 6 per cent and 4.5 per cent in the worst, base and best case scenarios, respectively.

S&P said it also expects Chinese regulators to relax rules for what counts as a bad loan and potentially give certain loans to affected communities and business "special consideration" in how they are accounted for on bank balance sheets.

The ratings firm said it "may take years for domestic banks to revert to normal standards, with long-term repercussions for the creditworthiness of some institutions."

China has already begun to take action aimed at stimulating its economy and easing conditions in its financial system. The loan prime rate, a key lending rate, was reduced on Thursday after the People's Bank of China earlier this week reduced another important medium-term lending rate.

https://news.google.com/__i/rss/rd/articles/CBMiP2h0dHBzOi8vd3d3LmZ0LmNvbS9jb250ZW50LzBmODZiODFkLWM4NDEtM2Q3MC1hMDY1LWE4ZjRjYzA4MzZkNdIBP2h0dHBzOi8vYW1wLmZ0LmNvbS9jb250ZW50LzBmODZiODFkLWM4NDEtM2Q3MC1hMDY1LWE4ZjRjYzA4MzZkNQ?oc=5

2020-02-20 08:56:00Z

52780621506012

Tidak ada komentar:

Posting Komentar