The taxpayer has netted a stake in sex party planning firm Killing Kittens under the terms of a scheme designed to help companies ride out lockdowns during the coronavirus pandemic.

The firm was handed support by the Future Fund (FF), set up by Chancellor Rishi Sunak in May 2020 to help "innovative" companies maintain access to finance.

Under the terms of the loans, which are administered by the state-owned British Business Bank, they are turned into equity on completion of a new funding round.

It meant, the Financial Times initially reported, that the UK taxpayer had taken a 1.5% stake in the company after Killing Kittens raised £1m from investors.

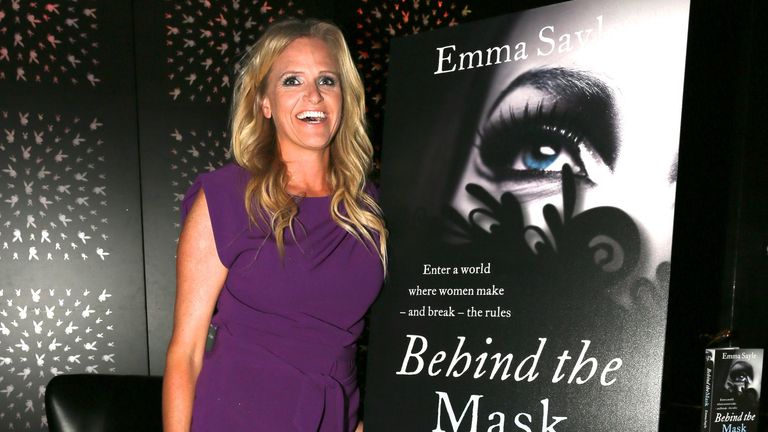

It was founded in 2005 by Emma Sayle, who describes Killing Kittens as a "sextech" firm that empowers women because of its strict rules.

Only women can approach men at its member-only functions globally.

It claims to have 180,000 customers.

Ms Sayle said the taxpayer had already secured a return on its investment and defended the aid in the face of criticism that it was not the sort of business that should be eligible for government-funded support.

She told Sky News: "The government's stake of 170k has already gone up 60% to 270k post this 1mill raise so we've easily shown that it's a worthy business given the hundreds of FF biz (businesses) who have gone into administration taking government money down the pan with them.

"We have clearly shown we are progressing... and making relevant decisions to secure money for all investors including the UK gov.

"As much pressure they came under for giving the money, they were there to back viable business regardless of sector and by converting we have shown we are also of our word in delivering what we said we would do in the short term."

A British Business Bank spokesperson said in a statement: "The Future Fund used a set of standard terms with published eligibility criteria.

"The process provided a clear, efficient way to make funding available as widely and as swiftly as possible without the need for lengthy negotiations.

"Applications that met all the eligibility criteria received investment."

https://news.google.com/__i/rss/rd/articles/CBMibGh0dHBzOi8vbmV3cy5za3kuY29tL3N0b3J5L3RheHBheWVyLW5ldHMtc3Rha2UtaW4tZXhjbHVzaXZlLXNleC1wYXJ0eS1wbGFubmluZy1maXJtLWtpbGxpbmcta2l0dGVucy0xMjY0MTE4MtIBcGh0dHBzOi8vbmV3cy5za3kuY29tL3N0b3J5L2FtcC90YXhwYXllci1uZXRzLXN0YWtlLWluLWV4Y2x1c2l2ZS1zZXgtcGFydHktcGxhbm5pbmctZmlybS1raWxsaW5nLWtpdHRlbnMtMTI2NDExODI?oc=5

2022-06-27 13:27:57Z

1482841457

Tidak ada komentar:

Posting Komentar