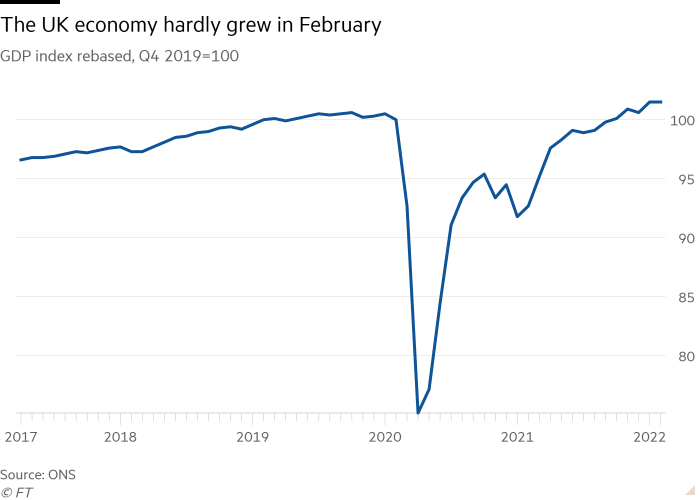

The UK economy barely expanded in February as weaker activity in the health sector, supply chain disruption and storms undermined strong tourism growth, raising analysts’ concerns as the cost of living surges.

Gross domestic product grew 0.1 per cent between January and February, down from 0.8 per cent the previous month, according to data published on Monday by the Office for National Statistics. Economists polled by Reuters had forecast an expansion of 0.3 per cent.

George Lagarias, chief economist at the global consulting company Mazars, said the overall economic backdrop was “fragile and due to weaken further”, as inflation continues to climb because of soaring energy bills.

This reading indicates “the UK economy is showing more signs of fragility than the US”, said Susannah Streeter, markets analyst at Hargreaves Lansdown, the financial services group.

Darren Morgan, the ONS director of economic statistics, said: “The economy was little changed in February with the easing of restrictions for overseas travel — and increased confidence in booking holidays in the UK — triggering strong growth in travel agencies, tour operators and hotels.”

Tour operation and accommodation output grew by 33 per cent and 23 per cent respectively.

However, this was partially offset by the reduction of the Covid-19 Test and Trace and vaccination programmes, which boosted growth at the start of the year but contributed to a 5.1 per cent contraction across the health sector in February.

Overall, output in the services sector, which accounts for 80 per cent of the UK economy, grew 0.2 per cent, down from 0.8 per cent in the previous month, while output in the other sectors fell.

Manufacturing production fell 0.4 per cent, with the automotive sector continuing to struggle to source parts.

Kitty Ussher, chief economist at the Institute of Directors, a professional organisation, pointed out that the drop in production could be the result of “falling demand from the end consumer worried about the rising cost of living.”

Construction output also fell 0.1 per cent, as storms disrupted activity.

Clive Docwra, managing director at property and construction consultancy McBains, said that although storms Eunice, Dudley and Franklin had an impact on work delays, “more serious underlying concerns over factors such as energy price rises, disruption due to the Ukraine crisis and rising inflation are triggering nervousness both from investors and in the construction sector itself”.

The economy was 1.5 per cent bigger than its pre-pandemic level, pushed by upward revisions in previous months.

The figures largely predate Russia’s invasion of Ukraine, which pushed up energy and commodities prices as well as costs for UK businesses and consumers.

Samuel Tombs, economist at Pantheon Macroeconomics, predicted that GDP would contract in the second quarter, “as the recovery in consumers’ spending peters out and as output in the health sector continues to fall back to earth”.

Given this weak near-term outlook for GDP growth, he forecast that the Bank of England would stop raising its main interest rate after increasing it to 1.0 per cent next month.

The ONS on Monday also published UK trade data, which showed that the trade deficit widened in the three months to February.

The value of goods exports rose to £28.6bn in February, from £26.5bn in January, but stayed below the £29.2bn average level in 2018, before Brexit deadlines and then Covid affected the data. Due to surging prices, UK real goods exports were 12 per cent below their 2018 average.

https://news.google.com/__i/rss/rd/articles/CBMiP2h0dHBzOi8vd3d3LmZ0LmNvbS9jb250ZW50LzIwYmI0NjAyLTgwOTctNGQ0Mi1hZDdlLTg0NWM4NmYxYjJkNtIBAA?oc=5

2022-04-11 08:26:15Z

1380053060

Tidak ada komentar:

Posting Komentar