Kohl's earnings and sales for the latest quarter fell short of analysts' estimates, the company reported on Tuesday. It also cut its profit outlook for the full year.

Its shares tumbled more than 12% in premarket trading on the news.

Here's how Kohl's did for its fiscal third quarter compared with what analysts were expecting, based on Refinitiv data:

- Earnings per share: 74 cents, adjusted, vs. 86 cents expected

- Revenue: $4.36 billion vs. $4.40 billion expected

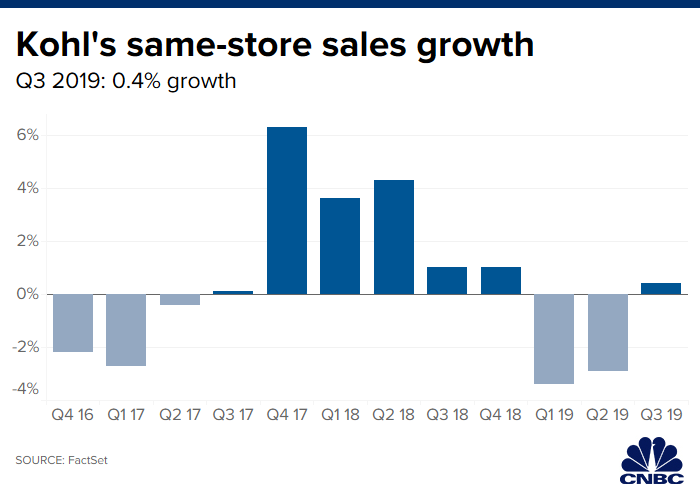

- Same-store sales: up 0.4% vs. growth of 0.8% expected

Kohl's said it now expects to earn an adjusted $4.75 to $4.95 per share for fiscal 2019, compared with a prior range of $5.15 to $5.45. Analysts had been calling for $5.19 a share.

Net income during the period ended Nov. 2 fell to $123 million, or 78 cents per share, compared with $161 million, or 98 cents a share, a year ago. Excluding one-time items, Kohl's earned 74 cents per share, short of expectations for 86 cents, based on Refinitiv data.

Net sales fell to $4.36 billion from $4.37 billion a year ago, missing expectations for $4.4 billion.

Sales at Kohl's store open for at least 12 months and from its website were up 0.4%, short of expected growth of 0.8%.

"The quarter started off positive in August with another successful back-to-school season and ended strong in October," CEO Michelle Gass said in a statement. "We enter the holiday period with momentum and are strategically increasing our investments."

Gass said "investing in the short-term" should help the company "drive profitable growth over the long-term."

The entire department store sector has been hit with heightened pressure this year and especially heading into the holiday season. Brands like Nike are investing more in their own stores and website to sell merchandise, moving away from middlemen. Companies like Kohl's, Macy's and J.C. Penney are having to look for new ways to win shoppers. Sears and Barneys New York fell victim to bankruptcy.

Kohl's has been launching some of its own brands and relying on celebrity partners to generate buzz. Last month, it rolled out a home goods line designed by HGTV's 'Property Brothers' stars Drew and Jonathan Scott, called Scott Living. It has also started selling a new pet brand, in a partnership with celebrity comedian and TV host Ellen DeGeneres, called ED Ellen DeGeneres Pets collection, for pet costumes and play toys.

In 50 stores, it is testing pop-up marketplaces, where younger brands will rotate in and out. In 200 stores, it has been adding "beauty impulse" areas, showcasing 20 top beauty brands.

In 2017, Kohl's started working with Amazon to accept Amazon returns at some of its stores, and that option has now grown to be available at all of Kohl's more than 1,000 locations in the U.S. It remains to be seen if this can prove to be a profitable sales driver for the retailer, however.

Kohl's shares, as of Monday's market close, have fallen roughly 12% this year. The department store chain has a market cap of about $9.3 billion.

https://www.cnbc.com/2019/11/19/kohls-kss-reports-q3-2019-earnings.html

2019-11-19 12:07:00Z

CAIiEG_QnCUqVBG3mbvx0S5lvGoqGQgEKhAIACoHCAow2Nb3CjDivdcCMJ_5ngY

Tidak ada komentar:

Posting Komentar